Important Information

Please read this disclaimer fully and carefully before proceeding, as it explains certain restrictions on access to the proceeding section of this website and the distribution and use of the information and data contained therein. You are not authorised to access the proceeding section of the website until you have acknowledged and agreed to the confirmations at the bottom of this disclaimer.

The content (including but not limited to all information and data) contained in this section of the website is published by GLIL Infrastructure LLP (GLIL) and is provided on GLIL’s behalf by Local Pensions Partnership Investments Ltd (LPPI), which is authorised and regulated by the Financial Conduct Authority (FCA). LPPI is a fully owned subsidiary of Local Pensions Partnership Ltd.

This section of the website is not intended for the general public. Its content is directed at and published for persons who are defined as Professional Clients under the rules of the FCA, and specifically a UK pension scheme or the professional financial advisor to such a scheme. The services provided by GLIL are only available to persons classified as Professional Clients.

The contents of this website are only directed at Professional Clients in the UK reasonably believed to be of a kind to whom such promotions may be communicated.

This website and its contents is for information purposes only. Nothing contained in this website shall be construed as an offer, or solicitation of an offer to buy or sell any securities or other financial instruments. Shares of the investment funds described herein are offered solely on the basis of the information and representations expressly set forth in the relevant offering circulars, and no other information or representations may be relied upon in connection with the offering of the shares. The value of investments, and the income from them, can go down as well as up and you may get back less than you invested.

Nothing contained in this website constitutes investment, legal, tax or any other advice nor should any of the information or contents be relied on in making an investment or any other decision. You should obtain appropriate independent professional advice before making any investment decision.

GLIL was established in 2015 by Greater Manchester Pension Fund (GMPF) and the London Pensions Fund Authority (LPFA) with £500 million of capital commitments.

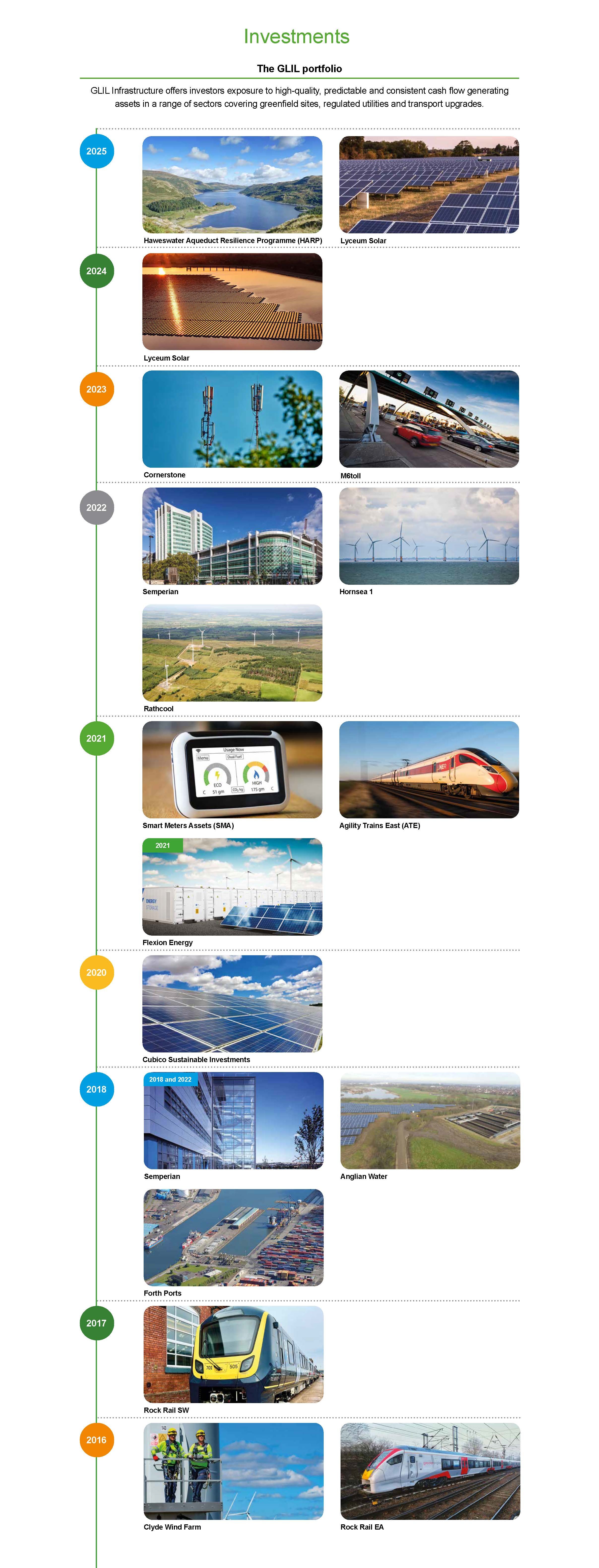

Today, committed capital is at £4.1 billion, of which £3.2 billion is currently deployed across 13 diverse assets. (31 December 2024)

In December 2016, Lancashire County Pension Fund (LCPF), Merseyside Pension Fund (MPF) and West Yorkshire Pension Fund (WYPF) were admitted as members of GLIL, increasing committed capital to £1,275 billion.

On 31 March 2018, GLIL Infrastructure became an open-ended fund structure to facilitate wider participation by UK pension funds, paving the way for new members. GLIL is categorised as an Alternative Investment Fund (AIF) for regulatory purposes and Local Pensions Partnership Investments (LPPI) was appointed by GLIL as the Alternative Investment Fund Manager (AIFM). LPPI is authorised and regulated by the Financial Conduct Authority. LPPI is a wholly-owned investment management arm of Local Pensions Partnership Ltd. Representatives from the four Founding Members are formally seconded to LPPI to allow them to participate in the investment decision making process managed by LPPI.