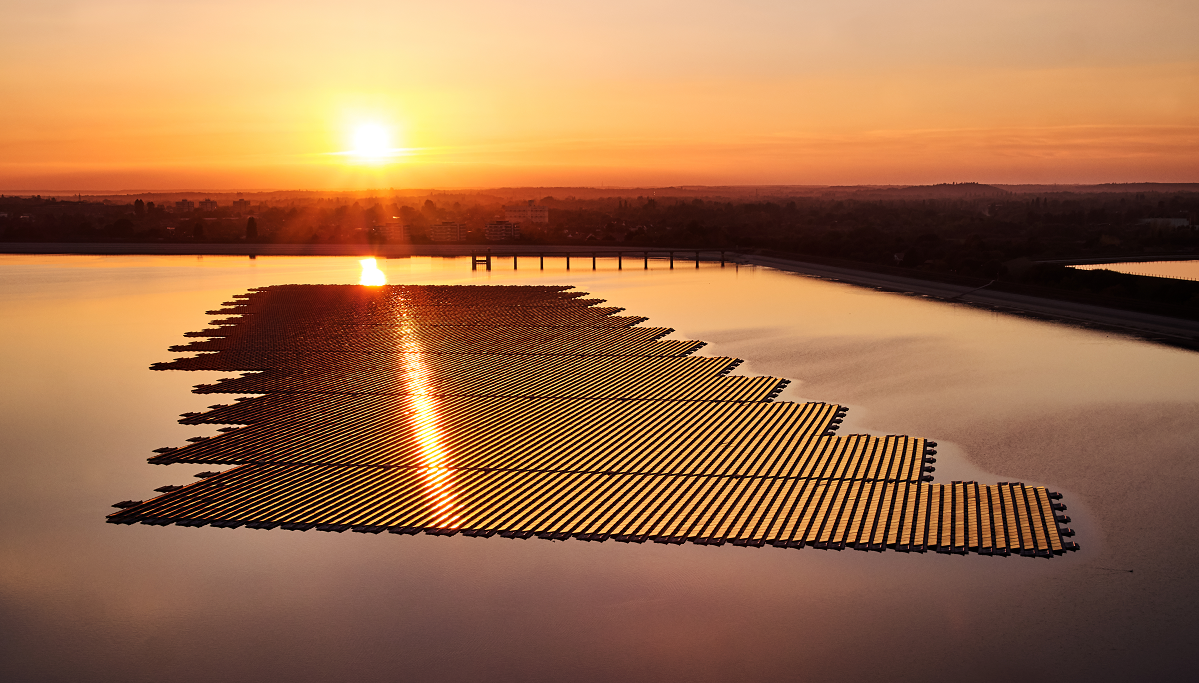

GLIL Infrastructure signs strategic partnership with Bluefield Solar to acquire Lightsource bp portfolio - December 2023

22 December 2023

GLIL Infrastructure has formed a strategic partnership with Bluefield Solar Income Fund (Bluefield Solar, LON: BSIF), the London-listed UK income fund, as part of a commitment to invest in UK-focussed solar energy assets. As a GLIL asset, this portfolio will be known as Lyceum Solar.

- GLIL to invest £200 million in a 247MW portfolio of operational solar energy assets

- GLIL plans to acquire a 50% stake in a separate 100MW portfolio of solar assets

- GLIL plans to invest in Bluefield Solar’s development pipeline

There are three distinct phases of the strategic partnership:

Phase one

The provisional agreement sees GLIL and Bluefield Solar create a new asset partnership and acquire a portfolio (the Lightsource bp portfolio) of 58 operational UK projects from Lightsource bp, a global leader in the development and management of solar energy projects.

The 247MW projects, developed by Lightsource bp from 2011, are predominantly located across southern and central England and include 184MW backed by Feed in Tariff (FIT) subsidies, 15MW by Renewable Obligation Certificates (ROCs) and two subsidy-free projects with a total capacity of 48MW.

The deal will see GLIL invest £200 million, and Bluefield Solar invest £20 million. The transaction requires approval under the Planning Act for Nationally Significant Infrastructure Projects and is expected to close in early 2024.

Phase two

As part of the second phase of the partnership, GLIL will provisionally acquire a 50% stake in a separate portfolio of more than 100MW of operational UK solar energy assets currently owned by Bluefield Solar. The deal is expected to complete in the first half of 2024.

Phase three

GLIL and Bluefield Solar have provisionally agreed to commit to funding a selection of the Bluefield Solar’s development pipeline, which are expected to be grid-connected over the next two to three years.

The investment in the Lightsource bp portfolio will further diversify the fund's renewable energy portfolio.

Julia Carter, Deputy Portfolio Manager, GLIL Infrastructure, said:

"This acquisition represents a strong strategic relationship with Bluefield and Lightsource bp that enables GLIL to access a substantial portfolio of operational solar energy assets as well as a maturing development pipeline. All our members are committed to driving the energy transition towards a sustainable net zero economy and these assets make a welcome addition to our growing clean energy portfolio.”

Chris Rule, Member of the GLIL Infrastructure Executive Committee, commented on the deal:

"Entering into a long-term strategic partnership with one of the most respected and leading asset owners in this sector is very exciting for GLIL. Being able to acquire and develop further renewable energy assets is very important for our Members, all of whom are deeply committed to investing in the energy transition and working towards a sustainable net zero economy."